Why it stands out: While some money market accounts offer higher rates for higher balances, Premier Members Credit Union takes the opposite approach - it rewards people who have lower balances with higher rates. Premier Members Credit Union Money Market Account ( jump to Premier Members Credit Union account details » ) You can make payments from your account digitally through sites such as Zelle and PayPal, but it might be inconvenient to not be able to write a check, pay with a card, or withdraw money from an ATM. What to look out for: The money market account doesn't include check writing or debit/ATM card access.

Money market account free#

You can link your CIT Bank money market account with PayPal and Zelle to make payments.ĬIT Bank is also offering a free one-year Amazon Prime members if you meet the requirements listed here. Why it stands out: With CIT Bank, you'll earn the same rate regardless of how much money is in your account, and there's no minimum balance requirement. CIT Bank Money Market Account ( jump to CIT account details ») But you can find banks that refund more money.

Money market account plus#

On the plus side, Synchrony reimburses up to $5 per month in out-of-network ATM fees. What to look out for: There's fees for out-of-network ATM withdrawals. Why it stands out: Synchrony doesn't have a minimum opening deposit, and the bank sends you both an ATM card and paper check. (Ally may waive this fee during the COVID-19 pandemic, though.) Synchrony Money Market Account ( jump to Synchrony account details ») What to look out for: If you make more than six withdrawals per month, you'll pay a $10 fee. The bank reimburses up to $10 per month in fees charged by out-of-network ATMs. Why it stands out: You can get paper checks and a debit card to make purchases when you open a money market account with Ally, and there's no minimum deposit. Ally Money Market Account ( jump to Ally account details ») What to look out for: There's no debit card or ATM card included. Sallie Mae also sends paper checks for you to access your money. Why it stands out: Sallie Mae pays a competitive rate, and the bank doesn't require an opening deposit. $100 minimum deposit required to open an accountĬomparing the best money market accounts of September 2022 Sallie Mae Money Market Account ( jump to Sallie Mae account details »).No Monthly Maintenance or Overdraft Fees.Earn up to 2.00% APY with a Quontic Annual Percentage Yield with a Quontic Money Market Account.Consult a tax advisor about IRA tax advantages.Certain withdrawal limits apply to Money Market Accounts and contributions to and withdrawals from the Money Market Select IRA Account are subject to IRS limitations, be sure to view the Member Handbook for details. The maximum number of checks that may clear is three (3) in any calendar month period.This calculator is for illustrative purposes only and does not reflect the actual results of any specific deposit amount.Limit one Money Market Select Account and one Money Market Select IRA Account per account number. No minimum deposit required to open an account. Withdrawing funds before one year will result in a different realized rate.

Blended APY shown assumes the amount entered is held in the account for one year. Total interest paid is the sum from each tier. Interest is paid at tier rates on balances within each tier. Rates are valid as of and are subject to change after account opening without notice. We care about every member’s financial well-being and are committed to helping and encouraging our savers to build good savings habits.Ĭheck out the chart below to see how much you could earn. But at Patelco, the first $2,000 deposited into our Money Market Select Account earns the highest interest rate.

2Īt many banks, only accounts with very high balances can enjoy higher savings rates. In fact because of our high interest rates, Patelco’s money market account has been named The Best Money Market Account in 2021 by Investopedia. One of the biggest benefits of a money market account over a savings account is that the interest rates are usually far superior. And at Patelco, we’ve got one of the highest rates around.

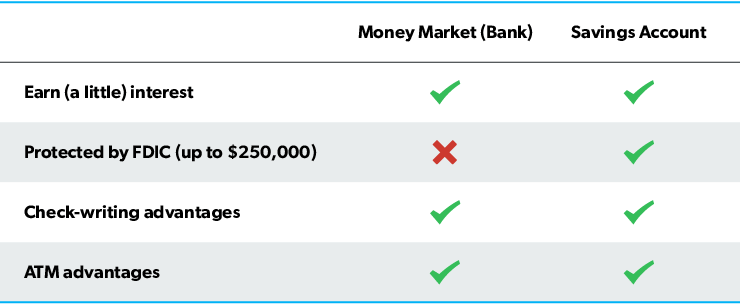

Like a savings account, a money market account is designed to help you save and earn higher interest. Money market accounts are especially good for building up your emergency savings and are insured by the National Credit Union Administration (NCUA) just like our other savings accounts.

0 kommentar(er)

0 kommentar(er)